Pension Scheme Investment Review – June 2021

The midpoint of the year tends to prompt a review of many things with an evaluation of our finances no doubt high on the agenda. Our pension and retirement plans are likely to feature in this assessment with differing degrees of interest. For those of us further along our career journey or more critically, reaching or considering retirement in the coming years this will be of greater focus. For the more youthful pension scheme members - or simply those with many years of contributions ahead of them - maybe less so. At whatever point you are along this path a regular review and

discussion is essential.

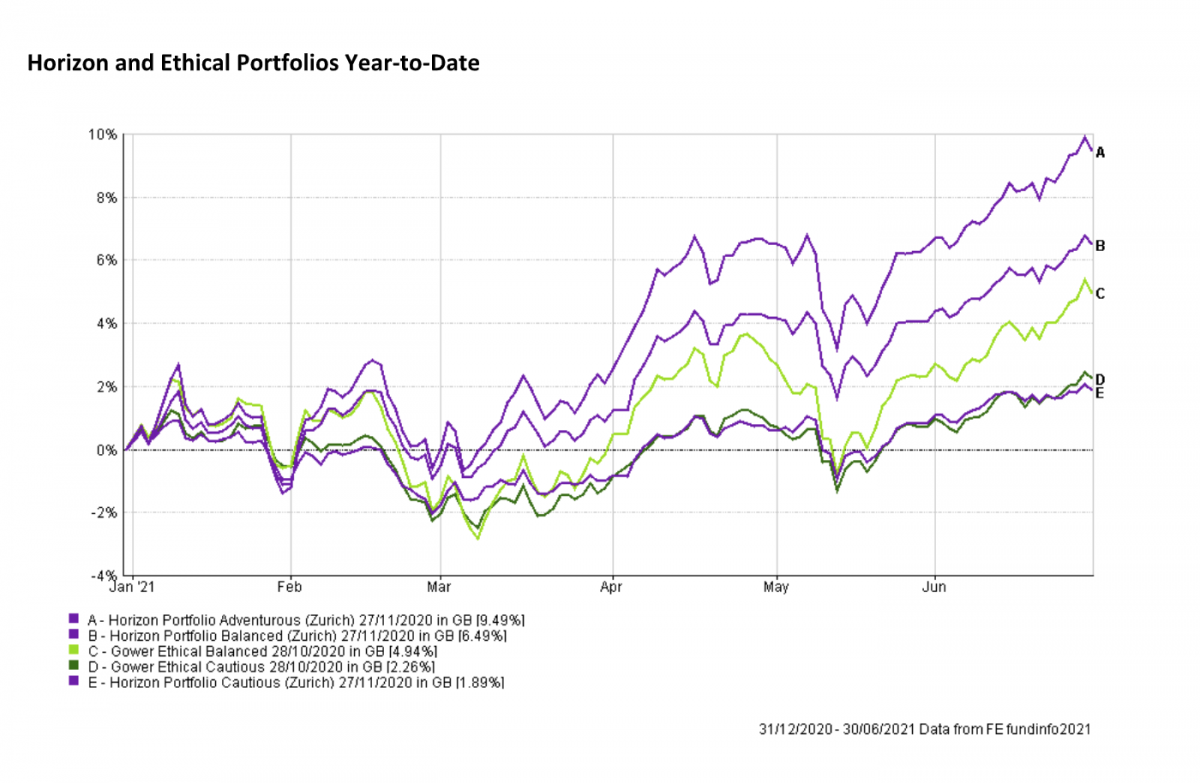

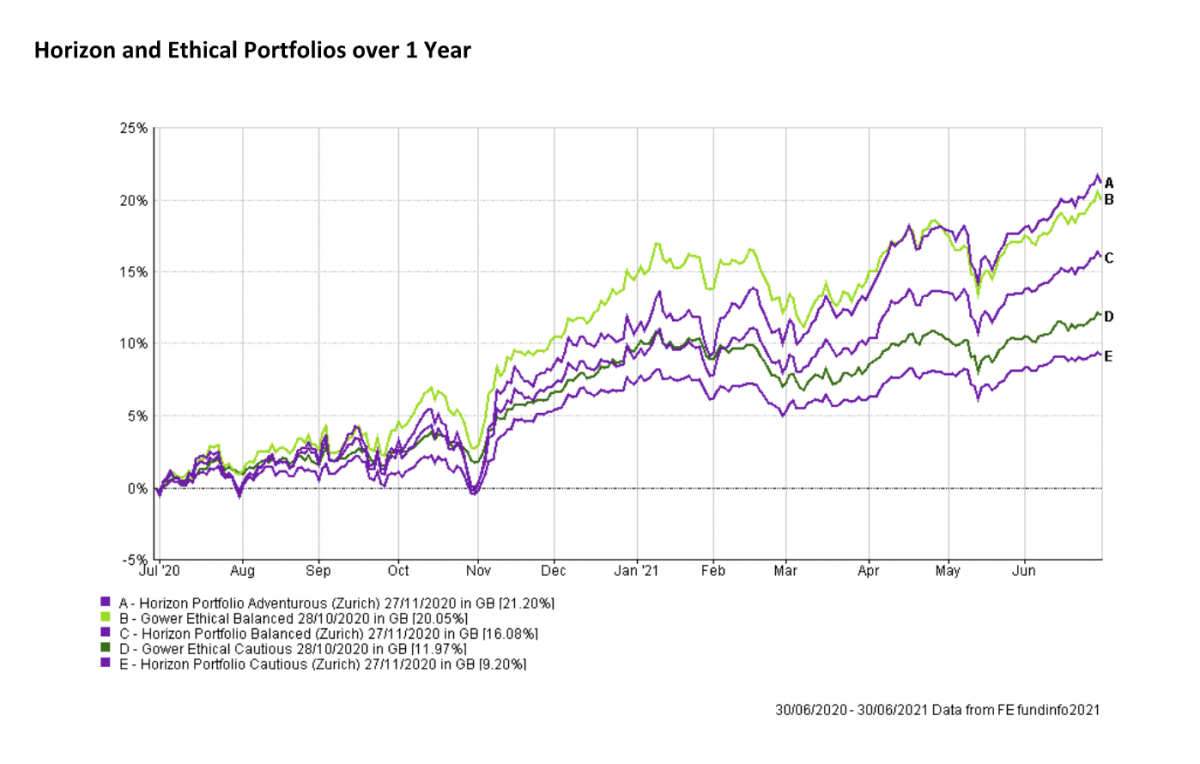

I am sure we have all heard plenty of footballing references of late but as the 2021 half-time assessment of financial markets is called (and importantly our Pension Member Scheme investment portfolios) there is much to be positive about as can be seen in the charts. Equity markets have mostly continued their steady improvement from the Pandemic lows of March 2020 as evidenced in the performance data, with all risk-rated Member Scheme Portfolios performing well.

It seems equally clear that markets remain in ‘recovery’ mode and further appreciation is therefore anticipated. Evidence of this can be seen from economic growth and earnings data currently being reported. If further evidence of the continued recovery were needed it is being manifested in other ways. One of the stand-out indicators that impacts us all and especially our pension investments is

the re-emergence of inflation and the rising levels we are currently witnessing.

How long the current trend continues will depend on a number of factors. A clear saviour throughout the Pandemic has been government subsidy, be it in the form of furlough payments or broader monetary and fiscal assistance, its swift deployment has been welcomed by all with stock markets being clear beneficiaries. This support will of course alter or potentially cease completely as we move into 2022 and beyond so we need to be conscious of these headwinds.

The prospect of higher taxes in the UK and overseas is inevitable and evokes a famed quote ‘the art of taxation consists of plucking the goose so as to obtain the most feathers, with the least possible hissing’. The word ‘art’ may be too gentle a description for what is to come in the coming global

hunt for taxes. It may also prove challenging for stock markets as they grapple with numerous developments that can potentially subdue - or at least disturb - future economic and stock market growth.

The need for well-diversified, robust investment arrangements to underpin retirement planning is therefore essential. As economies heat up, the portfolios will need to gather greater exposure to inflation-sensitive assets. Indeed, this process has already begun with added positions in

infrastructure, precious metals, commodities and inflation-linked securities now in place. This position will be monitored depending on how the current cycle develops.

Some commentators are already saying that the recent rise in raw material prices is the start of a 10-year trend known as a commodity super-cycle; this does not bode well for bills at the supermarket check-out. As has often been said - and repeated here for good measure - it is time in the market,

not timing the market that matters. Meeting these challenges with continued commitment to regular pension saving is equally important as it removes the emotion of when to invest and smooths out the peaks and troughs over time.

The best way to build a retirement income is through membership of a secure pension scheme. It is unrivalled given its clear tax benefits and long term strategic nature. Well-managed forms of pension investment, regularly reviewed, are therefore well-placed to optimise the chance of achieving

successful outcomes given the many and varied challenges inherent within financial markets.

In bringing this mid-term briefing to a close, I shall return to my earlier mention of where individuals may be on their retirement journey, as a number of members have recently asked similar questions regarding what happens at retirement. Such questions include estimates concerning retirement

income. How will the Scheme work? What are sustainable drawings each year?

The answer to these questions can of course depend entirely on personal circumstances, but often begins very simply. You do not necessarily need to take pension income straight away, or even trigger the withdrawal of a ‘tax free lump sum’ of cash; as tempting as that might be. It may be far

more tax-efficient to draw from existing capital, savings or other forms of investment if these reserves are available and dependant on tax efficiency.

A personal choice as to an appropriate level of cash reserve is always essential to cover emergencies. Preserving capital for its own sake may not always be its best use. Using up spare capital rather than paying tax on pension income may well be more efficient initially, unless you have legacy plans which clash with this style of approach.

State pension entitlement can also have a significant impact on how and when you chose to take an income from the pension pot. However, if you wish to begin drawing from your pension, a standard rule of 4 - 5% of pension wealth per annum can typically be drawn without eroding the underlying fund. This is often referred to as a ‘natural yield’. It is of course only an indication; we do not know what might constitute a ‘natural yield’ moving forward as it may be more, or less than the figures provided here. With interest rates close to zero in the Sterling zone – and even negative in the case of Europe – there will inevitably be a degree of distortion around this figure.

There are of course many variations on the above themes as everyone’s pension is framed around personal aspirations. This short summary is for guidance only and it is wise to discuss any aspect with a Financial Adviser. At Gower we are always happy to talk through any query or future planning requirement in an understandable and jargon-free manner.

Please note that these performance figures do not include investment management, custody or Trustee fees. They are for guidance only as your valuation will give an exact measure of returns.

Disclaimer

Past performance is not a guide to future returns. Please note that the value of your investments can go down as well as up and you could get back less than your original investment.

The information and views expressed in this blog is for general information purposes only and is provided by Gower Financial Services Limited ("Gower", "we"). While we endeavour to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the blog for any purpose.

The blog is based on the opinions of Gower and therefore does not reflect the ideas, ideologies, or points of view of any organisation with which Gower is, and may in the future potentially be affiliated with.

This blog does not constitute investment or financial advice or a representation that any investment strategy or service is suitable or appropriate to your individual circumstances.

Gower will not be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of the information contained within this blog.

Gower Financial Services Ltd is licensed and regulated by The Guernsey Financial Services Commission. Company registration number 37312 and has its registered office at Suite E3, Sarnia House, East Building, Le Truchot, St Peter Port, Guernsey, GY1 4EN.