Overview:

The frustration of the third Quarter spilled over into the fourth and the same can be said for the year as a whole. While most portfolios delivered positive returns, some were below the sector average, especially at the higher end of the risk scale. Areas that surged in 2020 went on to slump last year. These included Chinese equities and precious metals among others. While they rarely make the headlines the most important assets to suffer were fixed-income investments which are usually the low-risk bedrock of any portfolio. UK Gilts (government bonds) lost money for the first time in over 25 years. Bond prices had been rising relentlessly since 1982 so this reversal is highly significant.

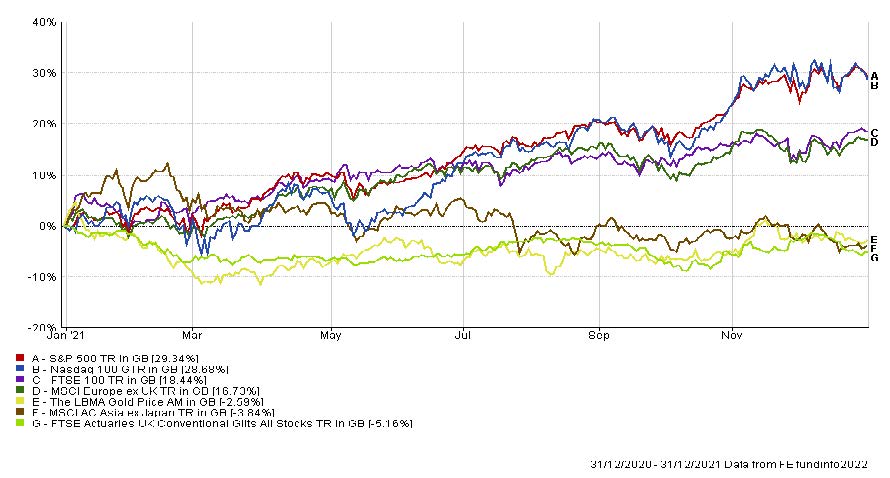

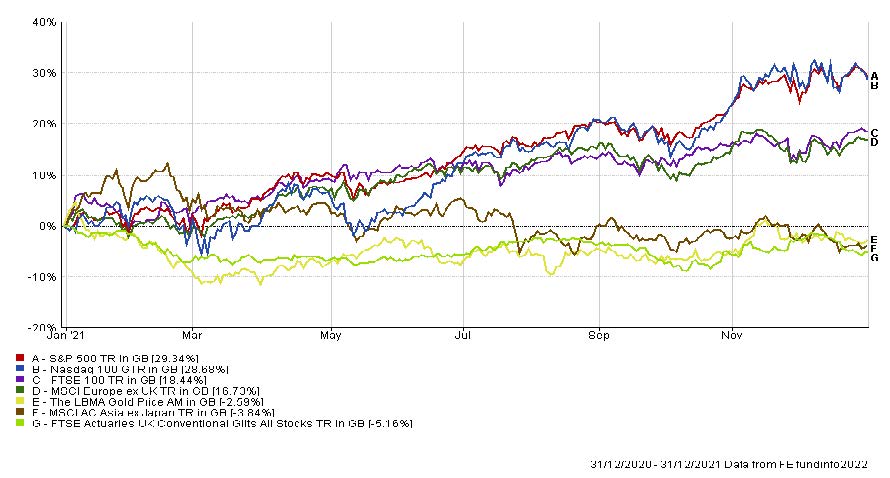

As can be seen in the chart at the bottom of the page, there was a major divergence in stock markets. America pushed ahead thanks to the usual household technology names such as Apple, whose valuation recently touched $3 trillion; equivalent to the entire value of the FTSE-100. It was interesting to see the main US index (S&P 500) march in lockstep with the Nasdaq technology index. It could be argued that components of the latter makes up a significant proportion of the former so the two indices are bound to converge. However, there is usually a bigger difference between the two. While markets appear to be buoyant on the surface the reality is that it is just a few mega-cap names that are driving ahead. Many other shares are floundering at 12-month lows making it very difficult for fund managers to run diversified portfolios. It is akin to an army being led by generals charging at the front while the troops have stayed in the trenches.

Meanwhile Europe and the UK had a decent run. These markets are dominated by so-called ‘old world’ shares such as industrial companies, commonly referred to as value stocks. This blanket term also includes banks which have been gradually dissolving before our eyes over the course of a decade. However, the expectation of higher interest rates has paradoxically been positive for financial firms as they experience an increase in profit margins. As banks recover then this bodes well for lending. While government stimulus has kept the ship afloat, it is lending that leads economic growth.

This Quarter is getting off to a wobbly start with some stock markets experiencing their worst single-day decline in almost a year. Having seen the Bank of England raise interest rates to 0.25% at the close of 2021 it appears that America will follow suit with three rate rises pencilled-in for this year. Other risk-assets like cryptocurrencies have also taken a hit. December job numbers for the USA were disappointing with just of 199,000 new hires which was well below expectations. The fact that unemployment has fallen further to 3.9% indicates a reducing participation rate as more and more people drop out of the labour pool. A record 4.5 million workers voluntarily quit their job in November (3% of the workforce). There were a variety of reasons for the re-shuffle by way of sabbaticals and early retirement but many are opting for a full career re-configuration or simply moving on for better pay and benefits within the same industry.

It is often the case that when a topic makes the headlines then the trend is already at its utmost and is about to turn. The jury is out as to whether this applies to inflation which is expected to peak at 7% in the UK over the coming months. Oil shows no sign of falling but of greater impact to the public has been the surge in natural gas prices which directly affects domestic heating bills. Energy providers who had been paying just 50 pence per therm a year ago saw the wholesale price smash through the £2 mark by the close of 2021. When your input costs quadruple but regulatory price caps prevent them being passed on to consumers then bankruptcy is inevitable and this has indeed been the case for some providers. The price cap is due to increase by 50% meaning that gas bills will rise by hundreds of pounds a year.

Investment Outlook and Market Comment

Winter of discontent

Many are familiar with this phrase from Britain’s slump in the late 1970’s but its origins are actually Shakespearian. While it is intellectually lazy to make direct comparisons with events in living memory there are some similarities with the economy of my childhood. Low growth, high debt and inflation, supply shortages and gridlock in public services are certainly a commonality. UK workers will need at least 7% pay rises simply to stand still once recent tax hikes are factored-in with inflation. To add to the misery, tax allowances are being frozen pushing millions into higher tax brackets.

It is no easier for companies either, whose input costs have risen by 14% over the year. They cannot pass on all of these expenses but have had to raise prices to some extent which then escalate throughout the supply chain. Shortages abound with higher shipping costs, delays in semi-conductor production and a dearth of skilled workers. The recent lack of truck drivers was exacerbated by the slow issuance of licenses by government staff while they worked from home.

China in transition

As we approach Chinese New Year next month, millions will be in transit as this is the key festival for families to re-unite. China itself is on an economic journey determined by the Communist Party’s 5 and 15-year plans and is currently in a transitional period. It may be likened to a caterpillar that has gorged and grown before emerging in its full glory after a static cocoon phase. This metamorphosis appears to be underway when the drive to become world leader took a breather last year as their real estate market stumbled. Some of the leading developers are undergoing severe financial distress which inevitably impacts the country as a whole, given that the property sector makes up 30% of the economy.

Aside from slowing growth and an ageing population there is a legacy of western-style debt levels in the aftermath of the property and consumption boom. Household debt is as high as 62% of GDP compared with just 40% back in 2016. Unlike other nations, it looks like China will be cutting rather than raising interest rates. They have also been undergoing something of an existential crisis with the emphasis on ‘common prosperity’ rather than a dash for growth at any cost. The preference toward domestic consumption over export production has implications for international inflation rates in future. If they no longer act as the world’s workshop then developed countries will need significant investment to replicate basic manufacturing; it is the price the West will pay for decades of outsourcing overseas with far-flung supply chains.

Commodity connections

The steep rise in crude oil and natural gas prices made the headlines last year. Typically for commodities a boom leads to investment in production capacity, allowing supplies to kick-in and ease shortages. This time round there appears to be a structural deficit such that by the close of this year demand will exceed pumping capacity; the first time it has occurred in 160 years. Even during the energy crises of the 1970’s this situation did not arise as constraints were political rather than physical. The anti-fossil fuel movement has led to major under-investment whereby lead-times will take years to catch up. Disappointing output from renewable sources - especially wind and hydro - has exacerbated the deficit.

The crisis is also interlinked with agriculture. A perfect storm of factors is combining to send food prices higher given that so many inputs are energy-dependent. Shortages have curtailed production and even led to closure of fertilizer and soybean processing plants in China and the UK. Should economies open up fully once more then the entire supply chain will be under strain. While precious metals have disappointed recently they may well be the surprise performer of 2022.

Bond market bellwether

The latest minutes from the US Federal Reserve meeting indicate higher interest rates ahead which has made bond prices dive. This has consequently driven-up long-term interest rates, known as yields which can be likened to a thermometer for inflation. Although it may not sound much, the yield on 10-year US government bonds has risen sharply to 1.80% and now stand above the highs of last March. There had been something of a conundrum last year as inflation was deemed to be ‘transitory’ but is evidently more permanent than previously thought. Another aspect for Americans is that mortgages are based on the level of long-term rates (whereas in the UK they are set by short-term rates). The risk going forward is that this extra burden will squeeze consumers as wages fail to keep pace with the current cost of living.

Outlook

The current backdrop may at first appear detrimental with higher interest rates while inflation remains elevated. We often repeat the phrase that ‘Wall Street climbs a wall of worry’ and this year should be no exception. It is therefore worth referring to financial history in times of uncertainty. Periods of rising interest rates and bond yields are often associated with major up-legs in stock markets. Likewise, strong double-digit gains in the US residential property market over the course of 2021 are a portent for enhanced consumer confidence going forward, thanks to the household wealth effect.

It may be the case that commentators are too pessimistic in comparing the coming year with episodes of stagflation in the 1970’s which bode badly for financial assets. Instead, a more useful parallel would be with the post-war period of 1946-66. This era saw control of fixed income markets known as financial repression. While it was bad for bonds it fostered a substantial upward re-rating of share prices. We expect positive returns from markets in 2022 but inevitably there will be corrections - most likely in this current Quarter - before equities and commodities move higher.

Risk Warning:

Please note that investments within the portfolios may go down as well as up and that you may therefore not get back the full amount invested. Where investments are denominated in foreign currencies, changes in the rate of exchange may have an adverse effect on the value or price of the investment in Sterling terms. Past performance is not necessarily a guide to future performance.

Disclaimer

Past performance is not a guide to future returns. Please note that the value of your investments can go down as well as up and you could get back less than your original investment.

The information and views expressed in this blog is for general information purposes only and is provided by Gower Financial Services Limited ("Gower", "we"). While we endeavour to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the blog for any purpose.

The blog is based on the opinions of Gower and therefore does not reflect the ideas, ideologies, or points of view of any organisation with which Gower is, and may in the future potentially be affiliated with.

This blog does not constitute investment or financial advice or a representation that any investment strategy or service is suitable or appropriate to your individual circumstances.

Gower will not be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of the information contained within this blog.

Gower Financial Services Ltd is licensed and regulated by The Guernsey Financial Services Commission.

Company registration number 37312 and has its registered office at Suite 2, Weighbridge House, Le Pollet, St Peter Port, Guernsey, GY1 1WL.