Investment Commentary - 3rd Quarter 2021

Overview:

This has been a frustrating time where most markets ended either flat or falling over the Quarter. After 18 months of powerful performance for riskier assets a pause and retrenchment was inevitable. Trouble has been brewing in China’s property sector while US Technology has been tepid. In spite of an ideal inflationary backdrop for precious metals they have likewise failed to shine. While we expect a strong final flourish to see out 2021 that is little consolation for now.

Journalists have dubbed recent market moves as the ‘September slide’. Looking from an historic perspective it is seasonally a month for negative returns with some particularly nasty sell-offs in the past, so it appears we have got off relatively unscathed. It is likely why October has statistically been a positive month as markets pick up steam from a low base to finish the year on a high. Over the last 7 decades, whenever America’s S&P 500 index rose by more than 15% by August then shares usually experience a strong run in the final Quarter. These gains are typically in the order of 4%. When stock markets notch up record highs through the year then the momentum trend favours a continued bull market.

As China’s economy grows larger, its influence on the world becomes ever more influential; for better or worse. At the moment it is the latter with a major property company called Evergrande teetering on the brink. Sales of its apartments are no longer sufficient to service their substantial debts. These stand at an eye-watering $300 billion. Much of the debt is with domestic government banks which will act as an economic drag, as they need to absorb losses for years to come. Given China’s past insularity, its problems have not been cause for concern by way of systemic risk internationally.

Where this affects overseas markets stems from the company’s inability to service the latest interest payment on its offshore bond. There is a 30-day grace period before this becomes a formal default. Real estate activity makes up almost a third of Chinese GDP and any domino-effect could hinder the country’s already faltering growth which has international repercussions. In the coming years China is looking to gather pace to leapfrog America as the world’s economic leader. It is therefore likely that a last-minute solution will be found to save face and avoid damage to the nation’s prestige and financial standing. The latest update is that that they are selling a majority stake in their property management arm worth $5bn to buy time. Trading in its Hong Kong-listed shares have been suspended to limit damage.

The other element that has curtailed China in recent months has been the move to take technology giants down a peg or two which has made its stock market one of the worst performers this year. Beijing has not appreciated the outspoken statements from some billionaires and has made moves to curtail their influence. Like Russia, China can accommodate capitalism and wealth as long as no one strays into politics. At the same time, perceived social ills are being tackled, for example by limiting youngsters’ time on gaming. On-line education – a long-time darling for overseas investors – has likewise been hit as teaching material now needs to be approved by the government. They are concerned about inequality as privately-educated children are gaining an advantage over those taught solely by the State. Their anxiety is part political and part philosophical. Many companies have been banned from raising money in foreign stock markets.

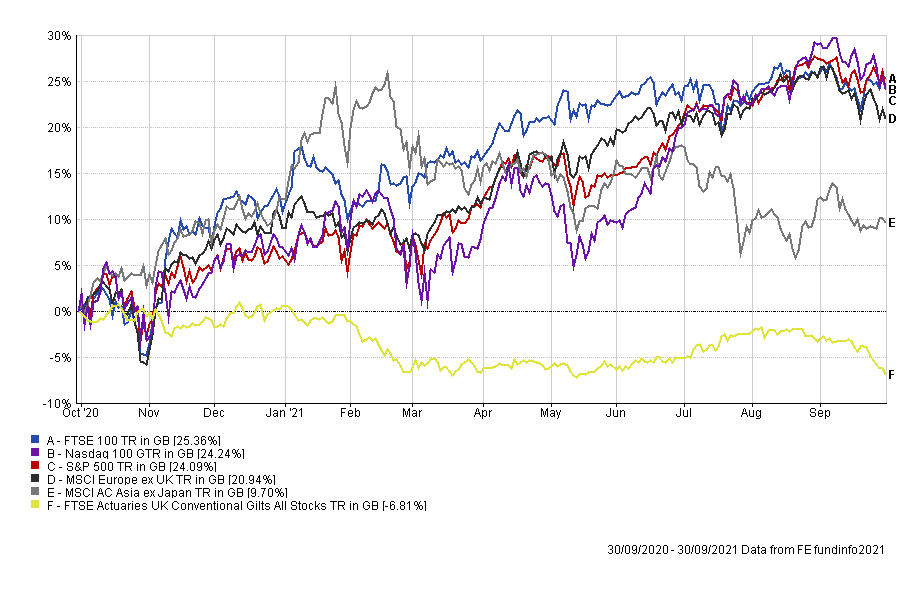

Looking at the 1-year stock market performance chart below, the large gains of last year are masking the recent downtrend that has been underway since the late summer. One can see a major divergence between America and Asia which reflects the comments above regarding a reining-in of capitalism in China. Over the last month markets have trended down which is not untypical moving into the autumn. We should however see a good rally in equities as we approach the year-end especially having come through the traditionally volatile month of September.

Investment Outlook and Market Comment

UK Stall Speed

Severe shortages of workers and supplies have dragged down economic growth in Britain to its weakest level since pandemic restrictions were eased in March. The latest snapshot from the Chartered Institute of Procurement and Supply showed that private sector output slowed in August as firms battled with severe shortages while costs rose at the fastest pace since the late 1990s. GDP – the principal measure of economic output – stalled in spite of many restrictions being lifted. The expectation of 0.6% growth came in at just 0.1%. There is now talk of a return to ‘stagflation’ which was last seen in the 1970’s. It is a combination of high inflation and low growth; the worst of both worlds.

This anaemic outlook will no doubt be exacerbated now that Boris Johnson has broken a manifesto pledge by raising National Insurance Contributions for some 25 million workers, by 1.25%. On top of that, employers will likewise be hit by a matching contribution cost. Another unexpected blow was to raise dividend taxation which affects many small and medium-sized business who in turn employ two thirds of the workforce. When inflation is thrown into the mix then it looks like a cocktail for stagnation. Economic growth and de-regulation are the best way out of a debt trap; not more taxation.

Lasting Inflation

While central banks are attempting to re-assure the public and markets alike with tales of ‘temporary’ inflation, the reality for consumers is much different, as anyone using natural gas heating is about to find out. The US Federal Reserve had previously played down inflation risks calling them ‘transitory’ because commodity prices were rising from a very low base when oil demand collapsed in 2020. This is known as the base-effect and big rises soon smooth out. However, other inflation gauges are cranking up even when food and energy costs are excluded. Price pressures are prevalent throughout supply chains in terms of delays, transport costs and labour shortages with panic-buying thrown into the mix.

As western economies open up there will be substantial pent-up demand which could see further price pressure. Freight charges for a single container from China to America have risen eightfold from $2,000 to $16,000 in just 18 months. These costs will have to be passed on to the end-consumer. The hackneyed economic cliché of more money chasing fewer goods is now reality. In the past there was always voluminous supply and output potential when commodities were cheap. Now the lack of computer chips and other raw materials has thrown the proverbial spanner into the production process. Money printing has also expanded the amount of capital in the economy by extraordinary amounts. Even during the 2008 credit crisis money in circulation grew on average by 6% per annum in the wake of Quantitative Easing, which came in three waves. This time round money growth peaked at 27% in 2020 and has only just settled down to 12%; double that of a decade ago. If there was ever a case of too much money chasing too few goods then this is it.

Supply Constraints

Shortages in the UK have resulted in the lowest level of car production since the 1956 Suez Crisis. The never-ending ‘pingdemic’ has forced millions of people to stay home which has hamstrung manufacturing, deliveries and services alike. Even second-hand cars are going up in price when they normally depreciate. Many politicians have only ever worked in the safety of the public sector and think that economies can be shut down and turned on again like a light switch. The reality is that many sectors have become dislocated and irreparably damaged. Even the smallest item is a product of hundreds of processes such that a shortage of any one component can cripple production. Small businesses - the lifeblood of employment and corporate taxation - have either closed, cannot expand or even recruit more staff because their capital hemorrhaged during lockdown. Furlough payments are no substitute for genuine organic growth.

Bond backdrop

Given the backdrop of money printing and diminishing purchasing power it is no surprise that bond prices have been falling. As they only offer low levels of interest and cannot grow like equities can, their desirability is waning. There is an inverse relationship such that the higher cost of money (in the form of rising interest rates) tends to push down the prices of these fixed income securities. Paradoxically, history shows that episodes of gradually rising rates can be surprisingly positive for stock markets. They are a barometer of economic activity in that greater demand for loans means that money costs more to borrow. Rising yields have often been accompanied by substantial upturns in equities over a relatively short time frame. While we have tended to avoid government bonds – which worked against us in March 2020 – this is now working in our favour for the lower risk end of the portfolio spectrum. We hold strategic bond funds which are designed to limit these losses and grind out positive returns in spite of the difficult terrain for fixed income assets.

Outlook

While recent news has focused on a single Chinese property company, its woes are symptomatic of a wider issue in China following the greatest property boom in human history. The demographics do not lie; the population has peaked and is ageing. This is an issue that Japan is experiencing where the populace is expected to halve by 2100. In spite of the difficult Quarter we remain optimistic for equities going forward. We should experience positive returns based on historic precedent. Investors are experiencing a high degree of fear right now but ironically this is a necessary backdrop for the next up-leg. Headline concerns are already factored-in and any positive economic news will see share prices rise sharply. This is most likely to stem from US employment data coming out in the first week of October. With the wind-up of generous benefits we should see a surge in job seekers filling the many vacant posts that are available.

Risk Warning

Please note that investments within the portfolios may go down as well as up and that you may therefore not get back the full amount invested. Where investments are denominated in foreign currencies, changes in the rate of exchange may have an adverse effect on the value or price of the investment in Sterling terms. Past performance is not necessarily a guide to future performance.

Disclaimer

Past performance is not a guide to future returns. Please note that the value of your investments can go down as well as up and you could get back less than your original investment.

The information and views expressed in this blog is for general information purposes only and is provided by Gower Financial Services Limited ("Gower", "we"). While we endeavour to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the blog for any purpose.

The blog is based on the opinions of Gower and therefore does not reflect the ideas, ideologies, or points of view of any organisation with which Gower is, and may in the future potentially be affiliated with.

This blog does not constitute investment or financial advice or a representation that any investment strategy or service is suitable or appropriate to your individual circumstances.

Gower will not be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of the information contained within this blog.

Gower Financial Services Ltd is licensed and regulated by The Guernsey Financial Services Commission. Company registration number 37312 and has its registered office at Suite 2, Weighbridge House, Le Pollet, St Peter Port, Guernsey, GY1 1WL.